THE PERFECT

MATCH

CONSULTING FINDS M&A TARGETS WITH KI AND BIG DATA

ADVYCE & PERLITZ

A MULTI-AWARD WINNING BOUTIQUE CONSULTANCY IN STRATEGY, INNOVATION, TRANSFORMATION AND M&A

Corporate acquisitions are a diplomatic balancing act. On the one hand, the potential buyer wants to know as much as possible about the companies in question in advance. On the other hand, they don’t want their interest to become known too early – especially not to those companies that, on closer inspection, are not worth considering after all. A leading international manufacturer in special vehicle construction entrusts Advyce & Perlitz with the identification and qualification of attractive candidates in various European target markets. In doing so, demanding criteria have to be fulfilled, according to which the thousands of companies in the industry have to be evaluated. . Different countries, different 90 languages – and many medium-sized companies that are often not very generous with their data: It is no small task to get an overall view here and to separate the more promising companies from the less interesting ones from the outset. But this is necessary so that the top-class industry experts receive a qualified pre-selection, where a closer examination is worthwhile.

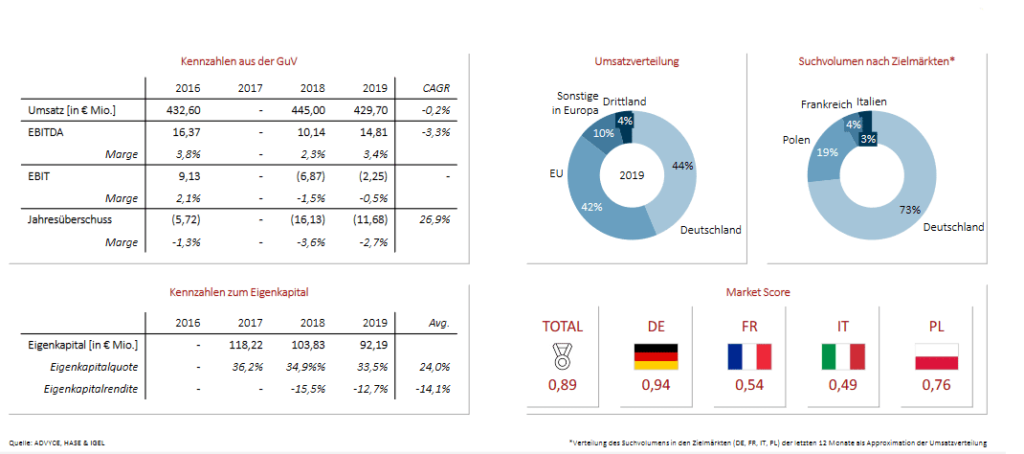

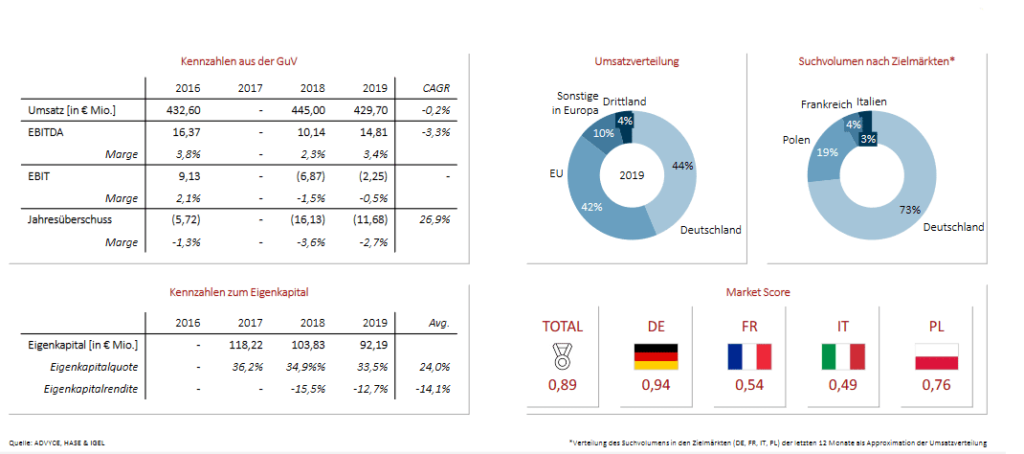

For this step, Advyce & Perlitz brings in its partner company Hase & Igel. Based on the technology of B2B CLIENT FINDER and AI TARGETER, Hase & Igel is developing a scouting and screening process with a high degree of automation for Advyce & Perlitz. First, the algorithms fill a database of all potentially relevant companies via an AI-supported search of various company databases, search results for relevant industry inquiries, and publications from trade media, trade fairs, and congresses. Market and behavioral data is then automatically included for these companies from more than 10 different categories for a preselection: from employee and sales figures, to the amount and origin of website visitors and brand/product searches, to advertising budgets and job offers, the number of branches or content of their websites. Based on this data, automatic benchmarking is performed within the industry and per country. Based on this, Hase & Igel, together with Advyce & Perlitz, develops a scoring that leaves less than a hundred companies. For these, the AI examines qualitative characteristics in greater depth, such as the content of media reports, employee and customer evaluations, in order to gain a more differentiated picture – for example, with regard to planned investments or service quality.

The highly automated intelligent survey and pre-selection of companies allows Advyce & Perlitz’s experienced M&A and industry experts to focus on the truly promising candidates. For these, they receive numerous standardized data on the company, market position and possible “red flags”. The consultants’ expertise can thus be fully concentrated on using their industry knowledge and networks to obtain the maximum depth of information and optimal classification – from studying the balance sheets to personal background knowledge on the shareholders to listening to industry talk. The client thus receives, with optimal efficiency, a thorough as well as discreet selection of those companies with which it is really worthwhile to start discussions – in significantly more breadth and depth than with conventional methods.

Hase & Igel GmbH

Julius-Mosen-Platz 3

26122 Oldenburg

E-Mail: kontakt@haseundigel.com

Tel: +49-4432-9884725